EQUI_ BRINGING CAPITAL TRADITIONAL CAPITAL TO BLOCKCHAIN.

EQUI is an upcoming ICO aimed at giving investors exposure to real-world companies by investing in new companies focusing on Next-Gen technology, real-world assets, and companies aimed at disrupting and overhauling major traditional industries. All of this exposure is given to investors in the form of tokens stored on the Ethereal platform, effectively bridging the gap between cryptosphere and real-world startup venture capital.

Experienced Team at Venture Capital.

The first thing that surprised me with Equi was the wealth of experience in the team. Many ICOs are launched by college kids who have no experience in the business world. This is not the case with Equi. Doug Barrowman, Lead Founder, has more than 30 years of experience in investing in startup companies. Doug serves as Chariman for Aston Ventures, a London-based venture capital fund, and takes advantage of the extensive connections in the venture capital industry.

Also on the team is the Baroness Michelle Mone (yes, he is the true Baroness of the Order of the British Empire). Baroness Michelle Mone has the experience of not only investing in startup companies, but really creating their own well done business. In such a way that he was made Baroness by His Majesty the Queen of England. She is widely known in the UK as an award winning Entrepreneur, but has also won awards in the US. He created a now-renowned clothing empire worldwide, winning the Achiever World Young Business title at Epcot Center in Florida.

Token Utility

EQUI token holders will have a direct exposure to corporate profits. On the EQUI platform, investors can choose the business they want to be part of, and thus earn 70% profit from the profits generated. What I love about the proposed platform is that investors can choose which startup companies they want to show off. Rather than relying on a basket index of all accumulated investments like traditional hedging funds, on EQUI platform token holders choose where to allocate their exposure.

In my opinion, 70% is a very generous profit share, with most projects with dividend payouts in blockchain typically generating only 20% -50% of the profits, and not allowing the flexibility to select investment exposures as is possible on the EQUI platform. .

There is also a fantastic system whereby one can invest in the future of the EQUI platform itself without risking any investment. By simply holding tokens on the EQUI platform without allocating them to a particular investment, investors will receive a 5% increase in their EQUI credits based on the number of EQUI tokens they hold. This is similar to how dividend payers dividend "share evidence" can work, unless no battles are required, and this allows those who believe that the EQUI value alone will go up to get additional tokens when they store tokens for long-term investments. .

Details of ICO.

There will be a total supply of 250 million EQUI tokens, at a price of $ 0.50 USD each during ICO. Investors with large capital (at least $ 100k) can follow pre-sales that will run from March 1-8, 2018 and receive a 25% bonus token issued. The main public ICO has no such minimum investment limits (only $ 100), and will operate from March 8-31, 2018. The public ICO will have an initial bonus of 15% for early birds that will last a week, so be sure to register early

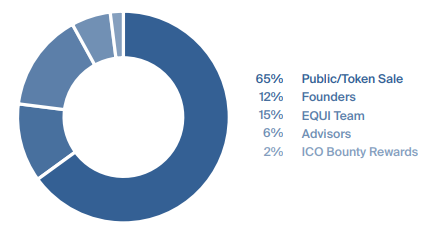

What I really love about this ICO is that most tokens are issued to investors - exactly 65%. The evidence allocated to the team also has a vesting time limit. What I really believe is that this team has experience with other venture capital firms, so chances are they will leave the project just to get rid of their tokens very low.

While there are many ICOs that aim to invest in traditional companies and allocate some benefits to their token holders, most of these teams are too technically focused with a small investment background. At the end of the day, you do not want a programmer with no investment experience because your project makes the decision to invest in a newbie to revolutionize a particular industry; You want an experienced fund manager who leads the ship. The Equi team is in a league of experience different from other projects, and that is why I believe that the track record of funding is proving to make the Equi project a good long-term, not a short-term one.

TIM.

Doug Barrowman, Founder Founder

Mayfair Baroness Mone, OBE, Founding Partner

Tim Eve, Director of Investment

Mark Lyons, Director of Investment

Luke Webster, Director of Investment and Compliance

Andrew Barrowman, Investment Manager

Andrei Karpushonak, Development Supervisor

Nerys Roberts, Marketing Director

Nicholas Graham, Head of Customer Service

Sim Singh-Landa, Project Manager

Anthony Page, Executive

Mark Pearson

Morten Tonneson.

Reference.

Please visit the following site for more information.

Website: https://www.equi.capital/

Technical Report: https://www.equi.capital/whitepaper/EQUI_Whitepaper_050218.pdf

Facebook: https://web.facebook.com/equi.capital/

Twitter: https://twitter.com/equi_capital

Telegram: https://t.me/equicapital

Medium: https://medium.com/equi-capital

ThrAnn BTT eads: https://bitcointalk.org/index.php?topic=2888110.

AUTHOR:

| https://bitcointalk.org/index.php?action=profile;u=880033 |

Комментарии

Отправить комментарий